Executive Summary

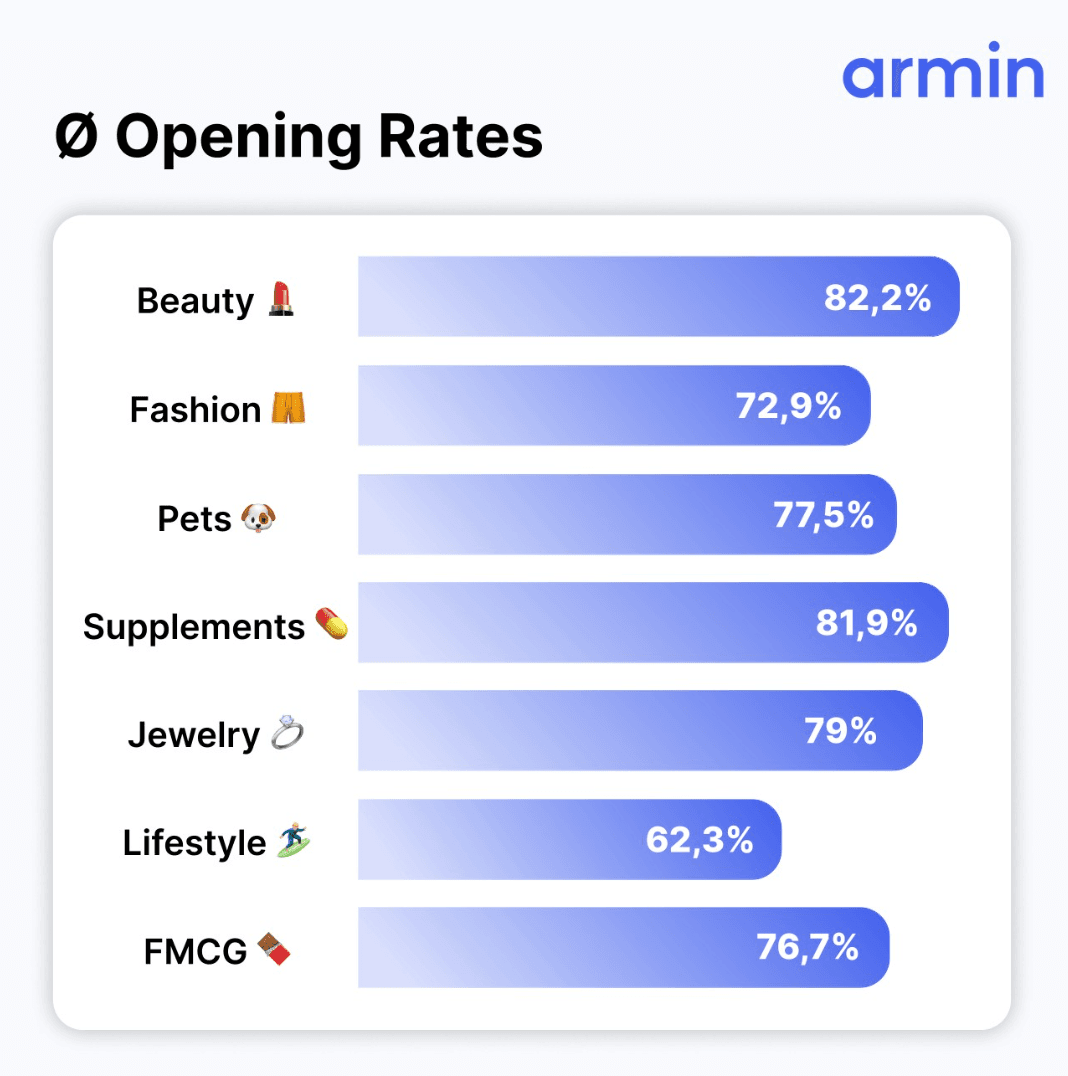

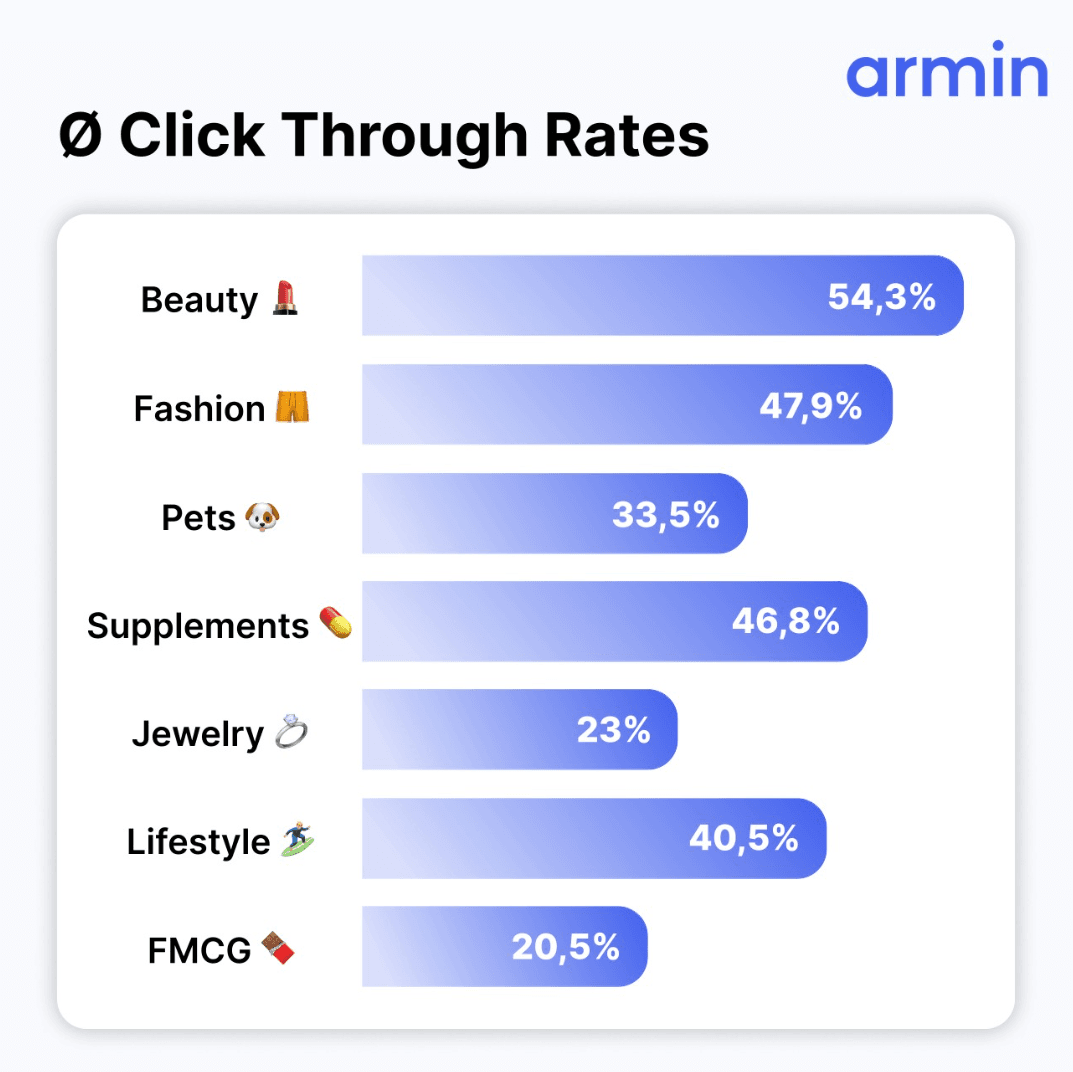

Over 30 e-commerce brands across 7 verticals, each with more than 100,000 WhatsApp conversations per year and at least seven-figure revenue, were analyzed. The key finding: most WhatsApp campaigns and flows fall within an ROI corridor of 15–60x ROWAS, with recurring outliers above 100x and some extreme values in highly intent-driven flows (e.g., Abandoned Checkout). Open rates typically range between 60–80% (without Blue Tick tracking), click rates between 5–15%, and conversion rates between 3–7% – depending on vertical, AOV, and use case. Some campaigns achieve significantly higher open and click KPIs (e.g., >70% open rate), with real values often another +10–15% higher due to “Grey Tick non-tracking.”

Note on measurement: Open rates in this study are reported without Blue Tick tracking; actual values are regularly higher in practice (WhatsApp does not reliably track all opens, particularly with “Grey Tick”).

Methodology & Dataset

- Basis: Published Chatarmin case studies (DE/EN) and documented campaign/flow results across industries (Beauty/Personal Care, Fashion/Lifestyle, Home & Living, FMCG Food & Beverage, Outdoor, etc.).

- Use Cases: Broadcast campaigns (Sales, Early Access, Restock) and automated flows (Welcome, Abandoned Checkout).

## Key Metrics by KPI

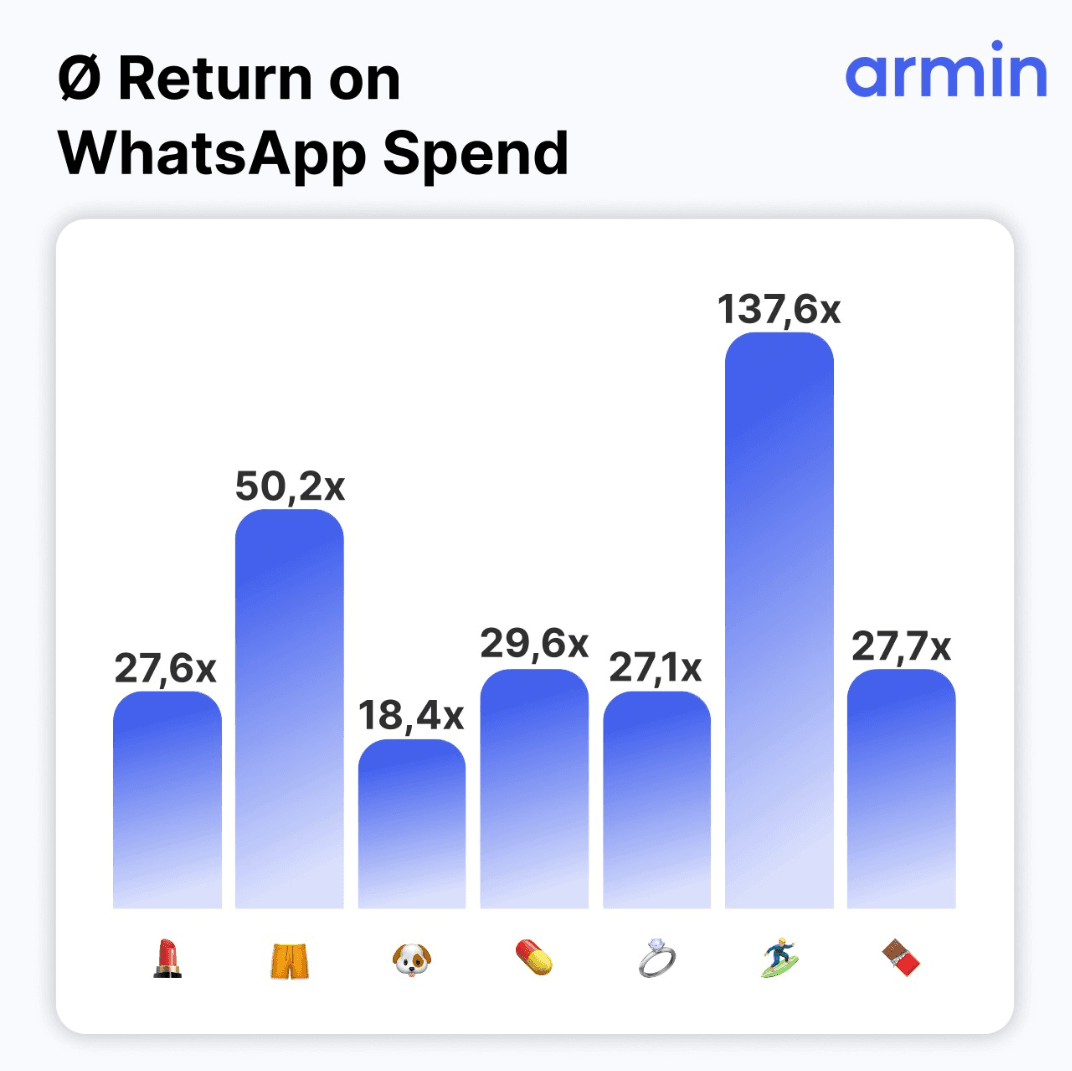

Return on WhatsApp Spend (ROWS)

- Median range: In our sample, most campaigns/flows cluster around 15–60x ROWAS.

- High-performing flows: Intent-driven automations (e.g., Abandoned Checkout, Welcome) often deliver much higher returns; outliers above 100x are not uncommon, with some flows reaching triple digits and beyond.

- Extreme cases: With very high AOVs or highly intent-based triggers, some cases reached >250x and even >1000x ROWAS; these should be considered separately from mass retention broadcasts (different mechanics/cost structures).

Verticals Compared (Nuances & Bias)

- Lifestyle/Fashion: Often shows above-average ROWAS – not due to the highest open rates, but thanks to higher AOVs and strong brand loyalty. Some high-AOV cases act as outliers and should not be read as retention mass benchmarks.

- Beauty/Personal Care: Typically lower AOVs → ROWAS looks weaker despite solid reach/opens; strong cases exist but scale better through repeated campaigns and CLV.

- Home & Living: Flows (Welcome/Abandoned) perform disproportionately well, especially for consultative, high-value baskets; campaigns thrive with clear value props (e.g., free shipping, bundles).

- FMCG Food & Beverage: High frequency, stable open rates, solid ROWAS; costs can be significantly reduced by smart use of the 24h conversation window.

- Other Verticals (Automotive, Grocery, Insurance): currently no reliable dataset available; no valid benchmarks.

- . Intent-driven flows as ROI drivers: Welcome and Abandoned Checkout consistently deliver the highest returns; broadcasts provide scale.

- . AOV-first mindset: Higher AOV outweighs small differences in open/click → prioritize offer and basket structure (bundles, up-/cross-sell, scarcity).

- . Segmentation by willingness to pay: Discount logic, product tester opt-ins, or tiered codes enable targeting by price sensitivity for future waves.

- . Creative framing: Positive, clear messaging first (avoid “rejection framing”) → noticeably better campaign ROAS in follow-up waves.

Benchmarks & Expectation Management

| KPI | Typical Range (Broadcast) | Typical Range (Flows) | Notes |

|---|

| ROWAS | 15–40x | 30–100x+ | Outliers >100x possible in both groups; extreme values in intent-driven flows |

| Open Rate | 60–80%* | 70–90%* | *without Blue Tick; real often +10–15% |

| Click Rate | 5–12% | 8–15% | Strongly influenced by offer & creative |

| Conversion Rate | 3–7% | 8–15%+ | Higher for abandoned/welcome flows |

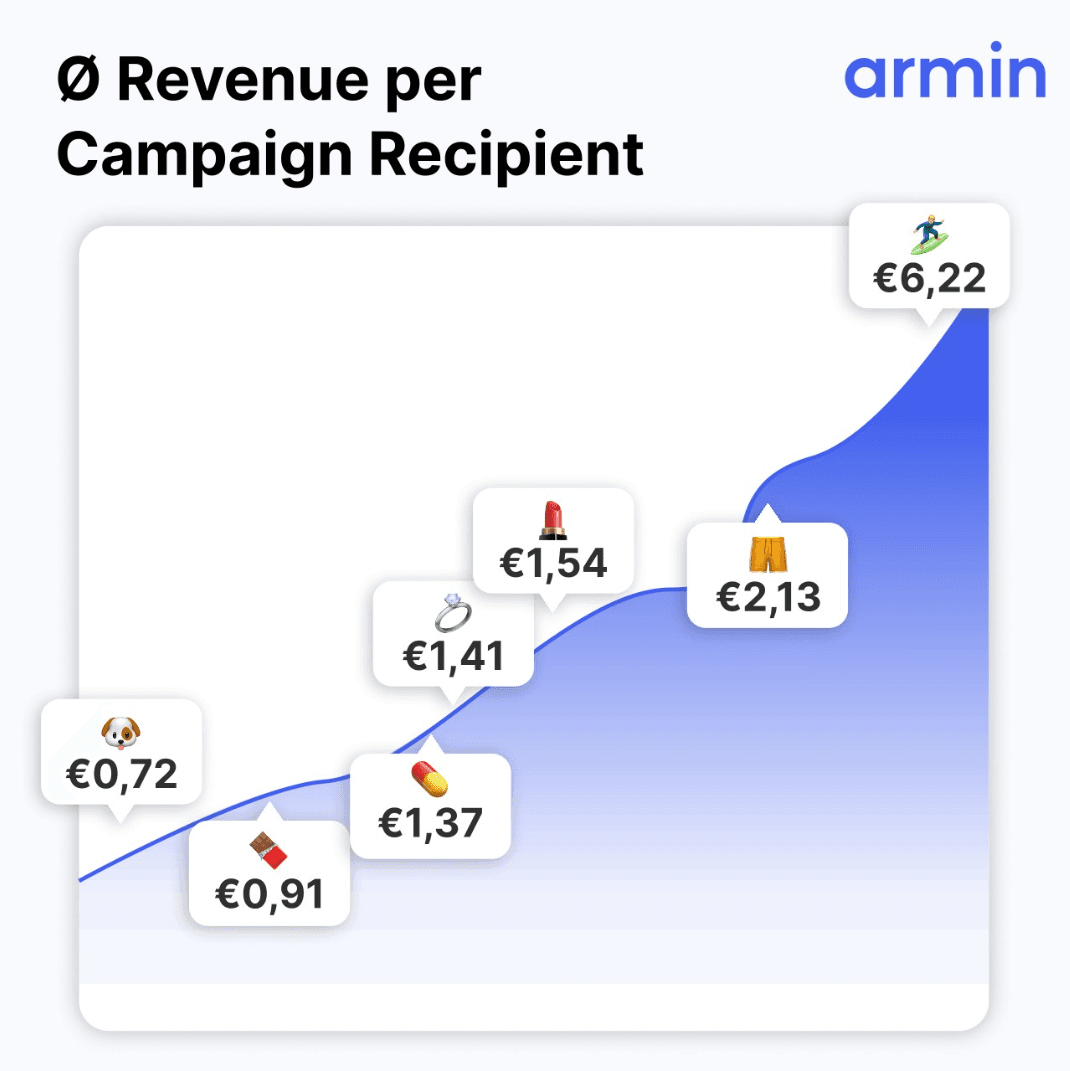

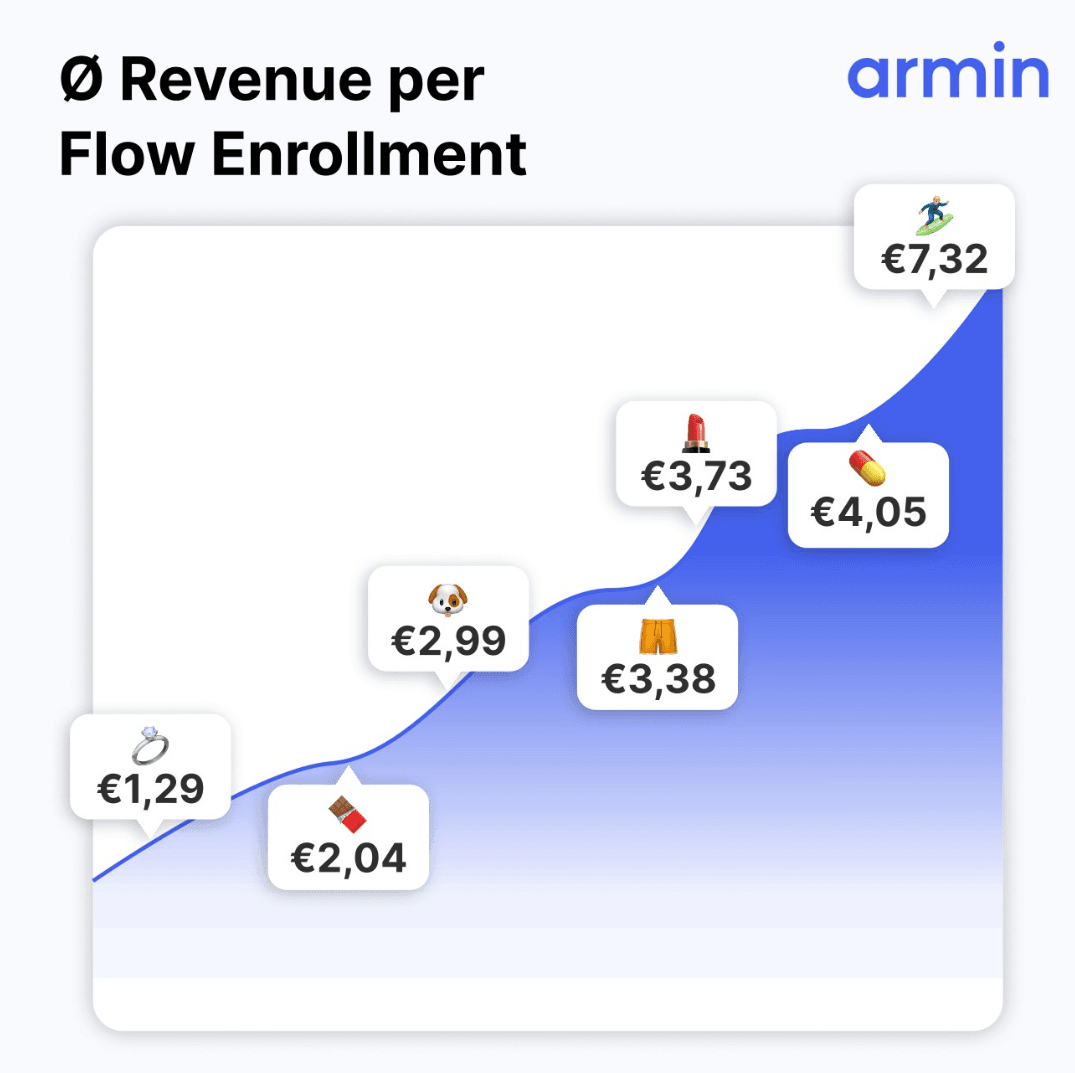

| Revenue/Recipient (RPR) | €2–€6 | €3–€10+ | Wider spread in high-AOV segments |

Extreme open/click cases documented in Beauty (anniversary campaign) and Home & Living (flows).

Limitations of the Data

- Measurement method: Open rates without Blue Tick; real opens regularly higher (non-tracking bias).

- Case mix: Some curated high-AOV sales campaigns skew averages → benchmarks should be read per vertical & use case, not applied 1:1.

- External verticals: For Automotive/Grocery/Insurance, no reliable samples yet.

- . Setup: Launch Welcome + Abandoned Checkout first; then scale broadcast calendar.

- . Increase AOV: Promote bundles/up-sells directly via WhatsApp; provide frictionless checkout links.

- . Segmentation: Use codes/offers for price sensitivity segmentation (more efficient future campaigns).

- . Creative hygiene: Lead with positive, clear value; keep rejections/disclaimers secondary.

Conclusion

WhatsApp is a scalable performance channel in DACH e-commerce with high engagement rates and above-average ROI. Brands that set up intent-driven flows and prioritize AOV levers consistently achieve results in the 15–60x corridor – with realistic potential for much higher outliers in the right use cases.

The question is no longer if WhatsApp works, but how fast teams implement the right use cases per vertical and measure them accurately.

👉 Download the full WhatsApp KPI Study here